2024 RESEARCH NOTE #3 Getting on the Platform

- Alt Leaders Survey

- May 20, 2025

- 2 min read

Updated: Oct 16, 2025

Alts Leaders Survey 2024 | Research Note #3

Executive Summary

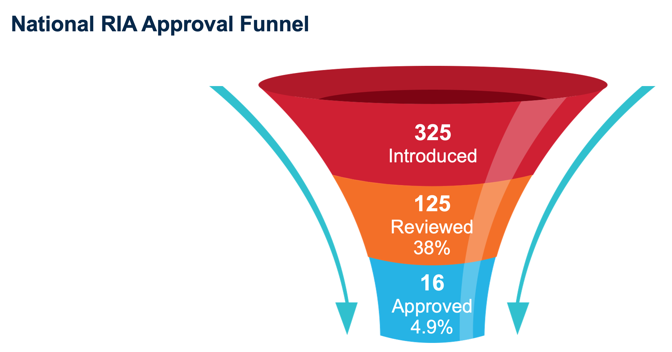

Platform approval is the critical gating issue for managers seeking capital from Private Wealth. Without it, even the best-designed product won’t see daylight. Onboarding is an essential but often opaque process. The journey from introduction to approval consists of three major milestones: Introduced, Reviewed, and Approved. Each stage sharply narrows the field, and conversion rates vary dramatically by channel. This note offers a data-backed view of what managers can expect at each stage. This research note sheds light, all things being equal, on the expected rate of success for Investment Managers.

Approval Funnel by Channel:

Visualizing the Approval Funnel:

Key Insights

1. Getting a meeting is progress. Getting reviewed is meaningful. But know your chance of approval ranges from just 5% to 13%. Set expectations accordingly.

2. Banks have the largest funnel intake but a low approval rate. It implies a desire to see as many market opportunities as possible, but they remain very selective.

3. National RIAs show similar review rigor but yield even lower final approvals, emphasizing alignment and fit.

4. Independent BDs are the most efficient path to approval, with a nearly 20% approval rate. Once you are under review, you have over a 50% likelihood of approval

5. Independent RIAs appear promising on paper, but approval is advisor-by-advisor. Without scalable access, it’s a grind.

Approval rates tell only half the story. Knowing what is already on their platforms is the flip side. Seeing what’s on the platform gives you essential insights.

Gaps in asset class exposure

Fund structures preferences

Which funds are nearing full subscription or sunset

Fund return profiles

Who will you compete with if your offering is approved

You can improve your chances considerably if you represent an asset class that is sought after, you have chosen the proper structure, and you know how to navigate the process.

The chart below provides context by profiling the average number of funds each channel offers, and which are continuously offered funds versus finite life.

Alternative Funds Currently Available

As of June 2024- Alts Leaders Survey

Incredibly valuable strategic insight emerges by overlaying funnel metrics with capital flow by channel, which we’ll explore in a future note.

Finally, shelf space is not expanding as quickly as the proliferation of funds. See the chart below which identifies some of the broad categories of funds courtesy of RAStanger.

There are 59 additional offerings (not including private equity, infrastructure, etc.) seeking capital. This number represents a 22% increase over 1 year earlier. Competition for platform approvals is intense. The number of firms who control the funnel has not grown in the last decade. Indeed, the opposite is true.

The 2025 Alts Leaders Survey will explore changes in above and provide a timeline from Introduction to Launch, how long will it take? Stay tuned.